r&d tax credit calculation uk

Use our RD tax credits calculator to get an indication of the cash benefit you can receive from claiming RD tax relief. Corporation Tax prior to RD Tax Credits Claim.

R D Tax Credit Calculation Examples Mpa

The Research and Development Expenditure Credit is a tax credit it was 11 of your qualifying RD expenditure up to 31 December 2017.

. Loss after deduction of profit. Our RD tax credit calculator gives you an instant estimate of your potential. Maximise your R.

Calculating your RD tax credit return may seem like a daunting and confusing task. Our free RD Tax Credit Calculator instantly crunches your numbers and shows how much in RD Tax Credits your business could claim from HMRC. If you dont have all.

Most companies in the UK that claim RD tax relief fit into the SME category. It was increased to. RD Tax Credits Whether youre new to RD.

Use our free tool to quickly estimate if youre eligible to claim RD tax relief. Across all sectors the average amount reclaimed for our clients is 50000. Just follow the simple steps below.

How to Calculate RD Tax Credit for SMEs. RD Tax Relief also called RD Tax Credits is a UK government subsidy that encourages businesses to invest in innovation. Use the RD tax credit.

Im new to Claming. R. RD tax credit calculation using the traditional method is based on 20 of a companys current year QREs over a base amount.

Select either an SME or Large. Call 01332 819 740. RD Tax Credits Explained.

The estimated total Research and Development RD tax relief support claimed for the tax year 20202021 was 66 billion This corresponds to 381 billion. 100000 X 130 130000. RD Tax Credit Calculation Examples - The calculation of your RD tax relief benefit depends if your company is a Profitable SME Loss making SME or Large Regime RDEC.

100000 x 230 230000. But its straightforward once you understand the basics. First however the fix-based percentage must be obtained by.

Say our example SME made a loss of 300000 for the year with the same 100000 RD QE and chose to surrender losses and claim relief. Put simply the scheme works by returning companies up to. Rd report for Based on the information you provided it looks like we could help you claim back up to for.

The UK RD tax credit scheme offers UK companies a great opportunity to claim tax relief based on RD costs. RD Tax Credit Calculator. The rate at which businesses calculate their RD tax credit depends on.

R D Tax Credits Explained In 2022 What Are R D Tax Credits Who Is Eligible

Credit Where R D Tax Credit S Due Cepr

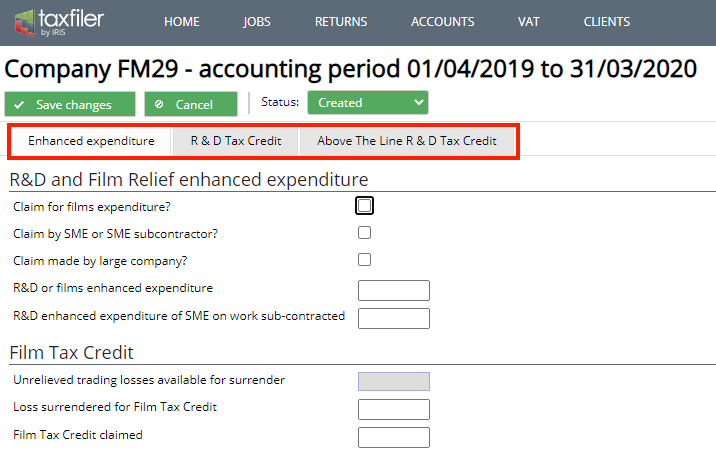

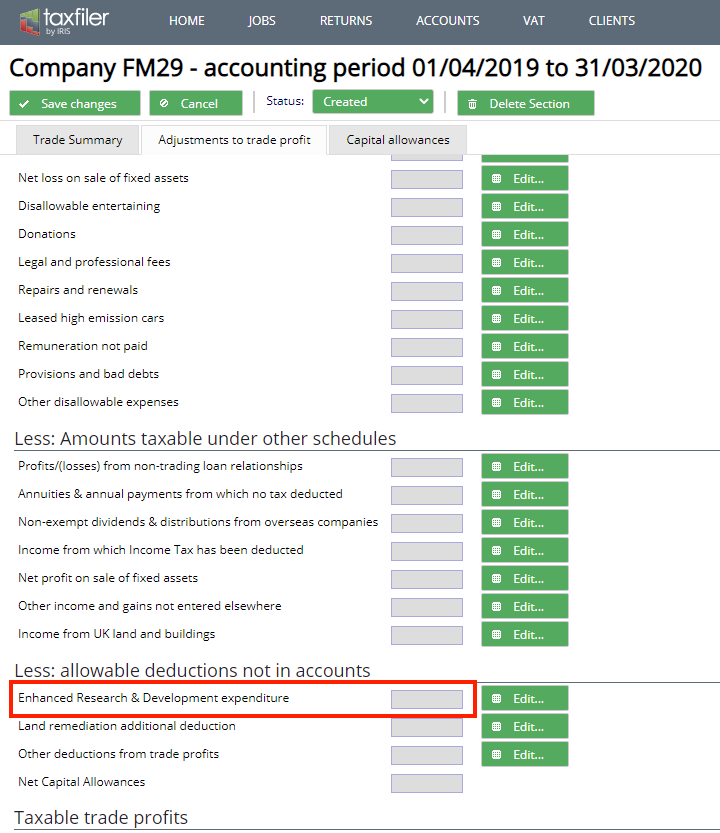

Research And Development Or Film Relief And Tax Credits Support Taxfiler

R D Tax Credits Essential Guide

Calculating The R D Tax Credit Randd Tax

Two Methods In Calculating For R D Tax Credits The Market Oracle

R D Tax Subsidies In Oecd Countries Tax Foundation

R D Tax Credits A Guide To Eligibility Claim Preparation And Calculation

Research And Development Or Film Relief And Tax Credits Support Taxfiler

Vantage R D Consulting Facebook

R D Tax Accountants Research And Development R D Tax Credits Claim For Small Businesses Dragon Argent

R D Tax Credit Rates For Rdec Scheme Forrestbrown

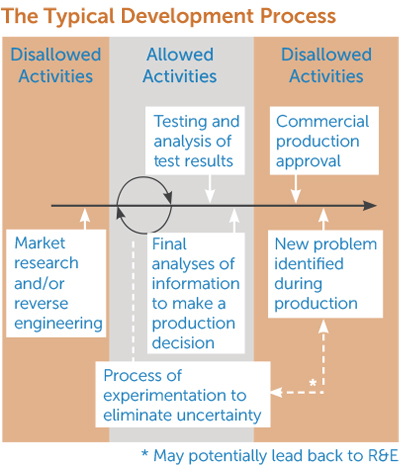

What S The R D Tax Credit Program Overview Cti

Tax Credit For Increasing Research Activities Tax Services Cla Cliftonlarsonallen

R D Tax Credit Calculation Examples Mpa